Invest with Actinver Bank, invest with confidence

Personal Financial advice

Get assistance in English from a personal banker in all your banking and financial needs.

Financial services menu

- Banking App

- Mutual Funds (USD/MXN)

- USD Accounts

- Loans

- Exchange rate

- Retirement Plans

- Debit card

- Insurance

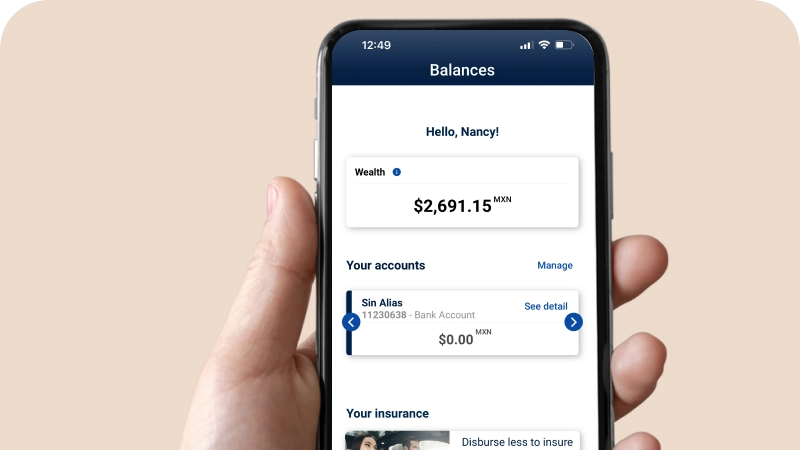

Banking in your hand

Experience seamless transfers, online payments for your services, investment portfolios, international debit cards, and more.

All available in one place and in english with Actinver App.

We’ve got you covered for all your financial needs

Investments

We assist you to start investing in Mexico. Our Investment banking service is ranked one of the best in the country.

- Dollar investing

- USD to Peso exchange rate

- Mutual Funds: Pesos and USD

- Global investments: Pesos and USD

- Specialized and themed investments: AI, Cloud, regional, nearshoring, health, commodities, etc…

Banking products

Get a debit card for cash withdrawals, online banking, receive and make cash deposits, pay bills, enjoy payroll portability, and open a USD-denominated MX account.

Loans

Get the loan you need and start a credit score in México:

- Car Loans

- Back to back Loans

- Easy process

Insurance

We take care of you:

- Car insurance

- Home insurance

- Travel Insurance

- Health Insurance

- Life insurance

With us, your banking in Mexico is easier

To open an account, you’ll need:

- ID (original passport with signature)

- Social Security Document (from your country)

- Telephone number

- Migration Form or Tourist Visa

- Proof of address (from Mexico or your country)

- E-mail address

- General data (beneficiaries, etc.)

FAQs

Frequently Asked Questions

It is preferable that you present a Mexican telephone number, it will also serve as your means of communication with Actinver.

Yes, Actinver's operations are regulated by banking regulators in Mexico.

Foreigners in Mexico, according to the tax authorities, must comply with the payment of taxes as long as they receive profits within the national territory. Depending on the type of investment (debt or equity), they may or may not be subject to taxation. For more detailed information, our specialists will be able to answer all your questions.

When you open your Actinver account you will be able to manage and administer everything related to it in an easier way with the Actinver app. Just go to one of our Financial Centers, meet with an advisor and open your Actinver account.

We have more than 48 financial centers across Mexico.

Atento usuario,

Estás saliendo del sitio seguro www.actinver.com para entrar a un sitio web ajeno a Actinver, el cual es responsable de sus propios contenidos, políticas de privacidad y seguridad.

Continuar¡Hola! Soy Lucy, tu asistente virtual. ¿Con qué puedo ayudarte?